Over 2 lakh directors to be barred from board posts

At least two lakh directors on the board of companies, whose names have been struck off by the Registrar of Companies (RoC), will be barred from holding any board position in new ventures although they will not have to step down from the board of other companies on which they are currently directors.

So far, names of 2.1 lakh companies have been struck off for not filing returns and not completing other formalities related to compliance after notices were served on 2.97 lakh companies that had failed to respond to show-cause notices. Sources told TOI that this number is expected to rise in coming months. The crackdown against directors will begin over the next few days.

The move to crack down on non-compliant companies by the ministry of corporate affairs (MCA) is part of an action on so-called shell companies, many of which exist only on paper and are often used as vehicles for round-tripping of funds or for money laundering. The government has set up a task force comprising MCA and revenue department officials to plug this gap in the system as it seeks to clamp down on black money . While the law allows oneperson companies, a majority of the companies have at least two directors, if not more. There are over 10 lakh companies in the country and the total number of directors will be in excess of 20 lakh.

The law allows the government to bar these directors from taking up any board po sition for five years, sources said. They will, however, be allowed to fulfil obligations related to the companies whose names have been struck off. In addition, their directorship on other boards is not being disturbed, a source said.“There is no intention to create problems in other companies. So we are for the moment staying away from acting against the boards of other companies,“ a source said.

On July 2, TOI was the first to report that MCA was launching an assault against directors on these companies and also informing banks about names of companies being struck off. Sources said the Reserve Bank of India as well as the Indian Banks' Association have been informed about the decision to strike off the names so that fund flow is choked. In the past, there have been instances where companies whose names had been struck off managed to have access to funding.

Courtesy -Economic Times

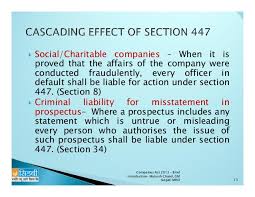

Directors disqualified under Section 164(2)(a) of the Companies Act, 2013 and who are associated with struck off companies (S.248) are advised not to make any application for Name Availability(INC-1), Incorporation of Companies (INC-7/SPICe-INC-32/URC-1/INC-12). Forms filed by such Directors shall be rejected summarily by the Central Registration Centre(CRC). Further, attention is drawn to the provisions of Section 7(5) and 7(6) which, inter-alia, provides that furnishing of any false or incorrect particulars of any information or suppression of any material information shall attract punishment for fraud under Section 447. Attention is also drawn to the provisions of Section 448 and 449 which provide for punishment for false statement and punishment for false evidence respectively.