A Corporate Debtor who is unable to pay its debts can

approach NCLT for a moratorium order to prevent any criminal action under

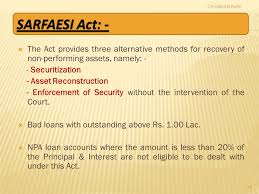

Negotiable Instrument Act or any recovery process under SARFAESI

Ultratech Engineering Limited - made a petition to NCLT, Mumbai bench under section

10 of the Insolvency and Bankruptcy Code 2016 and under Rule 7 of the

Insolvency and Bankruptcy Rules 2016 for initiation of Corporate Insolvency

Resolution Process.

Ultratech Engineering alleged in its petition that one

Sicom Investment and Finance Ltd , who is a financial creditor has warned the

company through a letter that they will be initiating an action under section

138 &141 of the Negotiable instrument Act ,1881 demanding the Ultratech

Engineering to pay Rs 5 Crores failing

which, a criminal complaint will be filed against the Ultratech and its

directors. Likewise, Canara bank who is

also creditor also demanded the Ultratech to pay its dues at the earliest. Likewise,

the Sales Tax department also issued an attachment order to one of its current

account with a bank.

The following documents were submitted by the

Corporate Debtor Ultratech Engineering as required Insolvency and Bankruptcy

(Application adjudicating authority) Rule 2016.

·

Forms

evidencing creation of charge by Ultratech Engineering in favour of its

financial creditors and lenders.

- · Copies of the audited financial statements and provisional financial statements

- · The details of its financial creditors and amounts owed to them

- · List of company shareholders

On the basis of the above, the Mumbai NCLT issued a

moratorium under section 10 of the I&B Code 2016.

How a Moratorium Order Helps an Ailing Corporate Debtor?

The moratorium order issued by the NCLT Mumbai bench prohibits the institution of suits or

continuation of pending suits or proceedings against the corporate debtor (

Ultratech Engineering) including execution of any judgment , decree , or order in

any court of law , tribunal , arbitration panel or other authority;

transferring , encumbering , alienating or disposing of by the corporate debtor

any of its assets or any legal right or beneficial interest therein.

Any action to foreclose , recover or its property

including any action under the Securitisation and Reconstruction of Financial

Assets and Enforcement of Security Interest Act ,2002, (SARFAESI).

The operation of order of Moratorium issued by NCLT

will have effect from the date of its issue till the completion of the

corporate insolvency resolution process or until the NCLT bench approves the

resolution plan under sub-section 31 or passes an order for liquidation of

corporate sector under section 33 as the case may be.

It is to be noted that section 35 of SARFAESI Act, 2002 states that the Act overrides every other enactment. However , Insolvency and Bankruptcy Code 2016 overides all other acts , such as Negotiable Instrument Act , SARFASEI, any state Act.

Section 14 (1) of IBC states the following :

Subject to provisions of sub-sections (2) & (3) on the insolvency commencement date , the Adjudicating Authority shall by order declare moratorium by prohibiting all of the following - namely

(a) the institution of suits or suits or continuation of pending suits or proceedings against the corporate debtor including execution of any judgment decree or order in anhy court of law , tribunal , arbitral panel or other authority.

This is an important direction by NCLT as per section 14(1) of IBC in Ultratech Engineering case and in ICICI Bank Ltd vs. Innoventive Industries Ltd.

It is to be noted that section 35 of SARFAESI Act, 2002 states that the Act overrides every other enactment. However , Insolvency and Bankruptcy Code 2016 overides all other acts , such as Negotiable Instrument Act , SARFASEI, any state Act.

Section 14 (1) of IBC states the following :

Subject to provisions of sub-sections (2) & (3) on the insolvency commencement date , the Adjudicating Authority shall by order declare moratorium by prohibiting all of the following - namely

(a) the institution of suits or suits or continuation of pending suits or proceedings against the corporate debtor including execution of any judgment decree or order in anhy court of law , tribunal , arbitral panel or other authority.

This is an important direction by NCLT as per section 14(1) of IBC in Ultratech Engineering case and in ICICI Bank Ltd vs. Innoventive Industries Ltd.

No comments:

Post a Comment