NON-FILING OF LLP-11 (Annual Return) after 30th

May 2018 will entail a penalty of Rs 100/= per day.

What the Law Says ?

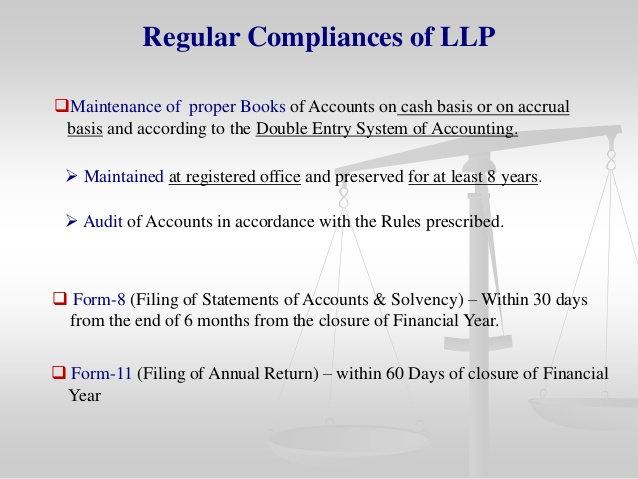

An LLP is required to file form LLP 11 (Annual Return) within

sixty days of financial year ending. Since 31st March 2018 is the

financial year end of all the LLPs , all the LLPs have to file the Form LLP-11

on or before 31st May 2018.

How Much Penalty is to be paid for non-compliance?

If form LLP-11 is not filed on or before 31st May 2018

, then a penalty of Rs 100/= per day is payable until the compliance is made in

this regard. If delay continues , the amount of fine may be higher if form

LLP-11 is not filed in time.

You are advised to file the

Form LLP-11 on or before 31st March 2018 to avoid the penalty

payment .

ReplyDeleteHello.. Wonderful blog with very useful information. Thanks for sharing this information with us. Visit our website for Annual Compliance for LLP Company

you are amazing first time i am reading this kind of good informative blog similar i have also want to read so click here llp roc filing due date.

ReplyDeleteThis blog is very helpful for me. Thanks for sharing this information with us. Visit our website for new gst registration online in India

ReplyDeleteLLP annual return filing involves submitting financial and operational details to the Registrar of Companies each year. This mandatory compliance ensures regulatory transparency and maintains the legal standing of the LLP. Timely filing is essential to avoid penalties and ensure smooth business operations.

ReplyDeleteLLP annual compliance is essential to maintain legal standing and avoid penalties. LLPs in India are required to file their annual returns (Form 11) and statement of accounts and solvency (Form 8) with the Registrar of Companies each financial year. Additionally, if turnover exceeds Rs. 40 lakh or if the partner’s contribution is above Rs. 25 lakh, an LLP must also undergo an audit. These filings ensure transparency and reflect the LLP’s financial health. Keeping up with compliance helps build credibility, fosters trust with stakeholders, and enables LLPs to focus on growth without legal hassles.

ReplyDeleteGreat Article ! Loved how you have explained everything in such breif.

ReplyDeleteAnnual Compliance for LLP