MCA CIRCULAR DATE 31ST JULY 2018 – CHANGES IN BOARD’S REPORT FOR OPC AND SMALL COMPANIES

MCA

has further amended the Companies (Accounts) Rules, 2014. These rules are now

referred as the Companies (Accounts) Amendment Rules, 2018.

COMPANIES (ACCOUNTS)

AMENDMENT RULES,

2018

New Rule 8A of the COMPANIES (ACCOUNTS) AMENDMENT

RULES, 2018 prescribed abridged form of

Directors Report for One Person Company and Small Company.

New Rule 8A

MCA has introduced

new Rule 8A after rule 8 under Section 134 of Companies Act, 2013

MEANING OF ONE PERSON COMPANY

One Person

Company is defined in Sub-Section 62 of Section 2 of Companies Act, 2013, which

reads: "One Person Company means a company which has only one

member". Under this type of Business Entity, there is no need for

mandatory minimum two directors, as is the case in Private Limited Company

incorporation.

MEANING OF A SMALL COMPANY

Section

2(85) of the Companies Act, 2013 defines “Small Company” in the following

manner:

Small

company’’ means a company, other than a public company,-

1.

paid-up

share capital of which does not exceed fifty lakh rupees or such higher

amount as may be prescribed which shall not be more than five

crore rupees;

2.

turnover

of which as per its last profit and loss account does not exceed two crore

rupees or such higher amount as may be prescribed which shall not be more

than twenty crore rupees:Provided that nothing in this clause shall apply toA)

a holding

company or a subsidiary company;

B) a company

registered under section 8; or

C) a company or body corporate

governed by any special Act;

“Matters to be included in

Board’s Report for One

Person Company and Small Company”

Rule 8A: As per rule

8A “Matters to be included in Board’s Report

for One Person Company and Small

Company:

NO REQUIREMENT OF MGT-9 FOR

OPC AND A SMALL COMPANY

Now , OPC and a Small Company need not to prepare

MGT-9 and to enclose along with the Board’s Report .

“STAND ALONE FINANCIAL

STATEMENT”

Director’s report of

OPC and Small Company shall be prepared on the basis of “Stand Alone Financial

Statement” of the Company.

INFORMATION TO BE CONTAINED

IN THE DIRECTORS REPORT OF OPC AND SMALL COMPANY.

Annual

Return in the Director’s Report

|

There

is no need to attach MGT-9 along with the Directors Report of OPC and Small

Company. It is adequate that the web link, if any, where annual return

referred to in sub-section (3) of section 92 has been placed;

|

Number of

Board Meetings held

|

Details

of the number of Meeting of Board of Directors

|

Directors

Responsibility Statement

|

Directors

responsibility statement as referred in sub-section 5 of section 134

|

Details of

the Frauds Reported in the Auditor’s Report.

|

Details

in respect of frauds reported by auditors under sub-section (12) of section

143 other than those which are reportable to the Central Government.

|

Board’s

Comment on Auditor’s Qualification

|

Explanations

or comments by the Board on every qualification, reservation or adverse

remark or disclaimer made by the auditor in his report.

|

The state

of the Company’s affairs;

|

Details

discussion about the company’s affairs in the Directors report.

|

The

financial summary and highlights;

|

To

provide synopsis of financial metrics of the company

|

Details

about material changes if any in the company during the year

|

Material

changes from the date of closure of the financial year in the nature of

business and their effect on the financial position of Company.

|

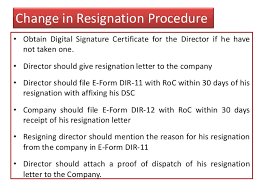

The details

of directors who were appointed or have resigned during the year;

|

Appointment

of Directors or resignation of directors during the year.

|

Outcome of

Litigations

|

The

details or significant and material orders passed by the regulators or courts

or tribunals impacting the going concern status and company’s operation in

future.

|

FORM AOC-2

|

The

report shall contain the particulars of contracts or arrangements with

related parties referred to in sub section (1) of section 188 in the form

AOC-2.

|