WHY A RESIGNING DIRECTOR FILE FORM DIR-11

WITH MCA?

·

Where there are

management disputes, in such companies, the directors still have an option to

file DIR 11 mainly to safeguard their interests.

·

Where the company has

not taken any action even after the receipt of the director’s resignation, filing

form Dir-11 will save the director any future actions taken against him for the

misfeasance of the board of the company.

·

In case of insolvent

companies , if form Dir-11 is not filed by a director , such directors personal

assets may be attached under IBC 2016.

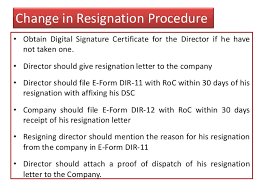

eForm DIR-11 has been introduced in the Companies Act,

2013

Director may resign

from his office by giving a notice in writing to the company and he is also

required to forward a copy of his resignation along with detailed reasons for

the resignation to the Registrar within thirty days of resignation in eForm

DIR-11.

The resignation of a director shall take effect from the date on which

the notice is received by the company or the date, if any, specified by the

director in the notice, whichever is later.

eForm DIR-11 is

required to be filed pursuant to Section 168 (1) of the Companies Act, 2013 and

Rule 16 of Companies (Appointment and Qualification of Directors) Rules, 2014

which are reproduced for your reference.

Section 168(1) of the Companies Act 2013

A director may resign from his office by

giving a notice in writing to the company and the Board shall on receipt of

such notice take note of the same and the company shall intimate the Registrar

in such manner, within such time and in such form as may be prescribed and

shall also place the fact of such resignation in the report of directors laid

in the immediately following general meeting by the company: Provided that a

director shall also forward a copy of his resignation along with detailed

reasons for the resignation to the Registrar within thirty days of resignation

in such manner as may be prescribed.

Rule 16:

Where a director resigns from his office, he

shall within a period of thirty days from the date of resignation, forward to

the Registrar a copy of his resignation along with reasons for the resignation

in Form DIR-11 along with the fee as provided in the Companies (Registration

Offices and Fees) Rules, 2014.

e-Form DIR-11:

1)

Where a director resigns from his office, he shall within a period of thirty

days from the date of resignation, forward to the Registrar a copy of his

resignation along with reasons for the resignation in Form DIR-11along with the

fee as provided in the Companies (Registration Offices and Fees) Rules, 2014.

2)

The Reasons should be clearly mentioned in the form for the resignation by the

Director.

3)

The form shall be digitally signed by the director itself who has resigned from

the office.

4) The resignation

shall take place from the date on which notice of Resignation is received by

the Company or any other Date specified by the Director in the notice

whichever is later.

5)

The Effective Date of

resignation {Field 4(B)} shall be the date as entered by the Company in e-Form

DIR-12 for cessation of the Director.

6)

Following Scanned Documents are mandatory and shall be attached along with form:

a.

Notice of Resignation filed with the Company

b.

Proof of Dispatch

c.

Acknowledgement received from Company If any (Mandatory only if yes selected at

serial no.6 in the form )

Status of Director Resigned will be

Changed to “ Resigned” after approval of DIR-11.

DIRECTOR’S IS STILL LIABLE

It

is to be noted that the concerned director shall be held liable even after his

resignation for the offences committed during his tenure as a director in the

company.

CHANGE IN THE STATUS OF THE

DIRECTOR AFTER FILING DIR-11

When a director files

eForm DIR-11 for intimating about his resignation before the company files

eForm DIR-12, an email will be sent to the company for filing the eForm DIR-12

and the status of the Director in the company will be changed to ‘Resigned’

against the selected designation. Once the company files the relevant eForm

DIR-12, the status shall be changed as per the existing system

If Directors are not advised not to file Dir-11

If a director has resigned since 2015 but

was not advised to file Dir 11. Can we still file now and specify effective

resignation as 2015 given that it has exceeded 270/300 days? What are the

possible penalties?

Yes, one can still

file DIR-11. The resignation of a

director shall take effect from the date on which the notice is received by the

company or the date, if any, specified by the director in the notice, whichever

is later. [Section 168(2)]. At

the moment, DIR-11 is not getting blocked for delay beyond 270 days.

Great information...Your post the very informative i have learned some information about your blog thank you for Sharing the great information.....

ReplyDeleteResignation Of Director Company