WHETHER STAMP DUTY EXEMPTION IS

APPLICABLE WHEN TRANSFER BETWEEN PARENT COMPANY AND SUBSIDIARY COMPANY

The

Central Government has exempted the payment of stamp duty on instrument

evidencing transfer of property between companies limited by shares as defined

in the Indian Companies Act, 1913, in a case:

(i) where at least 90 per cent of the issued

share capital of the transferee company is in the beneficial ownership of the

transferor company, or

(ii) where the transfer takes place between a

parent company and a subsidiary company one of which is the beneficial owner of not less than 90

per cent of the issued share capital of the other, or

(iii) where the transfer takes place between

two subsidiary companies each of which having not less than 90 per cent of the

share capital is in the beneficial ownership of a common parent company :

Provided that in each case a certificate is

obtained by the parties from the officer appointed in this behalf by the local

Government concerned that the conditions above prescribed are fulfilled.

However,

stamp being a state subject, the above would only be applicable in those states

where the State Government follows the above stated notification of the Central

Government otherwise stamp duty would be applicable irrespective of the

relations mentioned in the said notification.

STAMP

DUTY IN CASE OF AMALGAMATION / MERGER

In an

amalgamation/merger, business of the transferor-company, either whole or in

part, is transferred to the transferee-company. In other it is a transaction

facilitating transfer of the assets, properties, rights and liabilities of the

transferor-company to transferee-company. Amalgamation or merger is a

transaction under which transferor- company’s assets and liabilities are

transferred to transferee-company.

The decision to make such transfer is taken

by shareholders of both the transferor and transferee-companies. The scheme of

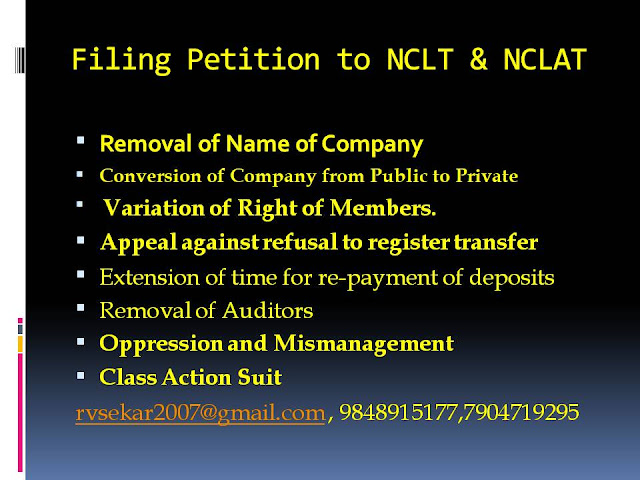

amalgamation has to be sanctioned by NCLT . Upon sanction by the NCLT and

filing a copy of the court’s order the amalgamation/merger becomes effective.

The transferor-company is dissolved.

Whether Stamp duty is payable on instruments.

Section 2(14)

of the Stamp Act, 1899 defines an instrument as under :

“(14) Instrument includes every

document by which any right or liability is, or purports to be, created,

transferred, limited, extended, extinguished or recorded ;”

As per the above definition, a

document creating or transferring a right is an instrument. If so, is an order

by a court effectuating the transfer a document?

This question was answered in the

affirmative by the Supreme Court in the case of Haji Sk. Subhan v. Madhorao where a decree

of the court was held to be a document.

Again in the case of Ruby Sales & Services (P.)

Ltd. v. State of Maharashtra , a consent decree was held, by the

Supreme Court, to be an instrument liable to be stamped. In this case the

decree was based on the agreement between the parties.

Order under section 394

An order under section 394 is also

akin to a consent decree which has the effect of transferring the properties,

rights and liabilities of the transferor-company to the transferee-company. In

other words it conveys the title in the properties of the transferor-company to

the transferee-company. Hence, it is an instrument liable to be stamped.

It is obvious

that transfer of property takes place between the transferor and the

transferee-companies in amalgamation or merger. The Stamp Act nowhere

specifically mentions amalgamation or merger in any of the articles which

contain entries of that are liable to be stamped.

SECTION 9 OF THE STAMP ACT

However,

remission from the levy of duty has been granted to transfer of property by one

company to another under section

9 of the Stamp Act. Relevant portion of the Central Government’s

Notification No. 1 dated 16th January, 1937 to this effect reads as follows :

The Stamp Act has been adopted by

almost all States in India except Maharashtra, Gujarat, Rajasthan, Karnataka and Kerala which have

their own Acts. These State Acts are also modeled on the line of the Stamp

Act, the only differentiating feature being the rates of duty which are

different from State to State.

Supreme Court in Hindustan Lever & Anr. vs.

State of Maharashtra & Anr. (2004)

The intended

transfer is a voluntary act of the contracting parties. The transfer has all

the trappings of a sale. The definition of 'conveyance' was an inclusive

definition an d includes within its ambit an order of the High court under

section 394 of the Act. It is therefore subject to payment of stamp duty

Bombay High Court in Li Taka Pharmaceuticals Ltd

vs State of Maharashtra State of Maharashtra [1997]

An order u/s

394 is founded upon compromise between the two companies of transferring assets

and liabilities and that order is an instrument as defined u/s 2(l) of Bombay

Stamp Act

Calcutta High Court in Re: Gemini Silk Limited v.

Gemini Overseas Ltd (2003)

An order

sanctioning a scheme of reconstruction amalgamation under Section 394 is

covered by the definition of the words 'conveyance' and 'instrument' under the

Indian Stamp Act and therefore

liable to stamp duty

WHETHER STAMP DUTY IS PAYABLE IN CASE OF

COMPROMISE OR ARRANGEMENT

Compromise

or arrangement does not fall within article 20(d) of Schedule IA of the Stamp

Act attracting stamp duty. In view of clear language employed in article 20(d)

of Schedule of the Stamp Act and sub-section (1) of section 394, unlike

amalgamation and merger, compromise or arrangement does not fall within

that article attracting stamp duty. Therefore, order of the Registrar of Assurance directing petition

company to pay requisite stamp duty is liable to be set aside being beyond his

authority.

Sir, if a resident indian transfer shares to foreign national then whether stamp duty will be paid.

ReplyDeleteIf we want funds from foreign director or shareholder without payment of interest then is it possible, if not, which is the best and appropriate method to raise the funds?