DISCLOSURE ON SIGNIFICANT

BENEFICIAL OWNERSHIP

OBJECTIVE

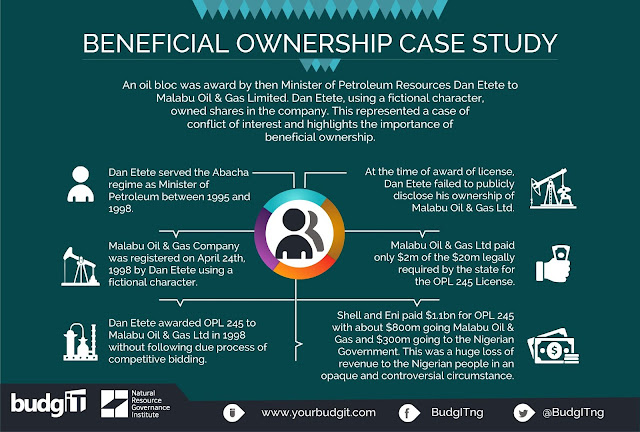

The main objective behind this step is to eradicate money

laundering and the objective of aforesaid disclosure is to identify the true

individual owners of a company, in case of complex layered structure. As the

implications of the amended section and newly notified rules are quite wide,

the companies have to take utmost care and the compliances of the same has to

be ensured in true letter and sprit.

APPLICABILITY:

All

Companies

REFERENCE:

Section

89 & 90 of the Companies Act, 2013 read with the Companies (Significant

Beneficial Owners) Rules 2018

DECLARATIONS, NOTICE, RETURNS, FILING AND MAINTENANCE OF

DOCUMENTS PURSUANT TO THE ABOVE SAID RULES:

A. Declaration of Significant beneficial ownership in

shares under section 90 by significant beneficial owner (Who is holding

ultimate beneficial interest or control) to the Company.

i.

Initial Disclosure Every significant beneficial owner shall file Form No. BEN-1

within 90 days from commencement

of these rules i.e. 14th June, 2018 (13th September 2018 is the last date

without fine)

ii. Continual Disclosure In case of any change

in the significant beneficial ownership every significant beneficial owner

shall file Form No. BEN-1 within 30 days

iii. Acquisition of significant beneficial

ownership after the Commencement of the said rule:

Every significant beneficial owner shall file

Form No. BEN-1 within 30 days from the date of acquisition of the significant

beneficial ownership or in case of any change in such significant beneficial

ownership

B. Return to be filed by the Company to Registrar.

Where

any declaration is received by the Company in Form BEN-1,

the

Company shall a return in Form BEN-2 within 30 days from the receipt of

disclosures from the significant beneficial owner.

C. Register of

Significant beneficial Owners Company

shall maintain register in Form No. BEN-3.

· Register shall be open for at least Two Hours

during business hours on every working day

· Company may charge fee but not exceeding Rs.

50/- for each inspection

D. Notice seeking information by Company about

significant beneficial owner

As

and when required the Company shall send Notice in form No. BEN-4 to any person

(whether or not a member of the company) whom the company knows or has

reasonable cause to believe— to be a

significant beneficial owner of the company;

· to be having knowledge of the identity of a

significant beneficial owner or another

· Person likely to have such

knowledge; or to have been a significant

beneficial owner of the company at any time

· During the three years

immediately preceding the date on which the notice is issued, and who is not

registered as a significant beneficial owner with the company as required under

this section.

Time line for replying the Notice

The

information required by the notice shall be given by the concerned person

within a period not exceeding thirty days of the date of the notice.

DEFINITION:

SIGNIFICANT BENEFICIAL OWNER An individual as referred to in section 90(1),

holding ultimate beneficial

interest of not less than 10 % of the share capital but whose name is not

entered in the register of members of as company as the holder of such

shares.

IN

CASE SIGNIFICANT BENEFICIAL OWNER IS OTHER THAN INDIVIDUAL OR NATURAL PERSONS

In

case Member

is Company

:·

The Significant Beneficial Owner is the natural person who holds not less than

10 % share capital of the company acting alone or together with other natural

person, or through one or more other persons or trusts or who exercise

significant influence or control in the company through other means.

In

case Member is Partnership Firms:

·

The Significant

Beneficial Owner is the natural person who holds not less than 10 % of the

Capital acting alone or together with other natural person, or through one or

more other persons or trusts or has entitlement to 10 % of profits in

partnership.

Where

no Natural Person is identified

:·

Who holds the position of senior managing official.

In case Member is trust (Through Trustee)

· The identification of the

beneficial owner shall include identification of the Author of the trust, the

trustee, the beneficiaries with not less than 10% interest in the trust and

other natural person exercising ultimate effective control over the trust

through the chain of control or ownership. Shares, for this purpose, shall include GDR,

CCPS, and CCD.

WHERE MEMBER IS

|

DETAILS

|

PERCENTAGE OF SHARE HOLDING |

|

Company

|

Significant beneficial owner is the natural person, who,

– Whether acting alone or

– together with other natural persons, or

– through

one or more other persons or trust

|

Hold atleast 10% of share capital of the Company or Who

exercises significant influence or control in the company through other

means.

|

|

Partnership Firm

|

Significant beneficial owner is the natural person, who,

– Whether acting alone or

– together with other natural persons, or

– through

one or more other persons or trust

|

Hold atleast 10% of capital or Has entitled to not less

than 10% of profits of the firm.

|

|

Where no natural person is identified under (A) and (B)

mentioned above?

|

In this case, the SBO is the relevant natural person who

holds the position of senior managing official.

|

|

|

Trust

|

The beneficial owner shall includes,

– identification of the author of the trust,

– the trustee,

– the beneficiaries with not less than 10% interest in the

trust and

– any other natural person exercising ultimate effective

control over the trust through a chain of control or ownership.

|

|

APPLICATION

TO TRIBUNAL

The

company may make an application to the Tribunal within 15 days from the expiry

of the period specified in the notice for an order directing the shares in

question for:

Restriction

on transfer of interest attached to the shares.

· Suspension of the right to receive dividend

· Suspension of Voting Rights

· Any other restrictions on all or any of the

rights.

NON-APPLICABILITY:

These rules are not made applicable to the

holding of shares of companies/body corporates, in case of pooled investment

vehicles/investment funds such as Mutual Funds, Alterative Investment Funds

(AIFs), Real Estate Investment Trusts (REITs) and Infrastructure Investment

Trusts (InvITs) regulated under SEBI Act.

PENAL

PROVISIONS FOR DEFAULT

For

Non-Filing of BEN-1

· Person shall be punishable with

fine which shall not be less than one lakh rupees but which may extend to ten lakh rupees and

where the failure is a continuing one, with a further fine which may extend to one

thousand rupees for every day after the first during which the failure

continues.

FOR

NON-FILING OF FORM BEN-2 AND MAINTAINING THE REGISTER THEREOF

· The company and every officer

of the company who is in default shall be punishable with fine which shall not

be less than ten lakh

rupees but which may extend to fifty lakh rupees and where the failure

is a continuing one, with a further fine which may extend to one thousand

rupees for every day after the first during which the failure continues.

For

Furnishing False Information

· If any person willfully furnishes any false or incorrect information or suppresses any material

information of which he is aware in the declaration made under this section, he

shall be liable to action under section 447.

STATUTORY AUDITOR NOW

HAS RESPONSIBILITY TO REPORT ABOUT SBO

·

Auditors’

while auditing the Company have to check whether there is any body corporate is

shareholder of Company ‘S’.

·

If Yes,

whether BEN-1 is received by the Company.

·

If BEN-1 not

received, whether Company sent notice to such persons.

·

If Notice

Sent, reply not received whether Company has taken action by applying to Tribunal.

In case of

non-compliance by the Company, auditor has to report the same in his Report.

COMPANY

SECRETARY IN PRACTICE HAS NOW RESPONSIBILITY TO REPORT ABOUT SBO

Secretarial auditor has to report about the company’s

compliance about SBO in his secretarial audit report.

DIRECTOR SHALL

BE CONSIDERED AS OFFICER IN DEFAULT IS FOR NON REPORTING OF SBO

·

It is

accountability of the directors as officer in default of a company to do

followings:

· They shall check whether there is any beneficial

owner of shares of Company in any Holding Company or in any Subsidiary, WOS,

associate Company

·

If Company

having any Holding Company has to follow process as mentioned in Section 90(5)

discussed above.

·

If Company

having Subsidiary, Associate Company they have to check whether their

shareholders required to file BEN-1,

·

If yes , the

company has to follow with them to file BEN-1 to subsidiary/ associate Company.

Excellent Post. Thanks for sharing your valuable content.

ReplyDeleteBharat Forge Limited (BFL)

Bharat Road Network Ltd

Bliss GVS Pharma Ltd

Bajaj Finance Ltd