Listed Companies

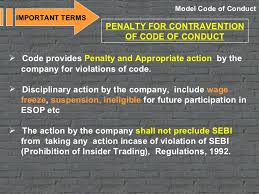

“ Company Secretary “ should be careful as they are liable to be fined for

Insider trading along with the other principal officials of the company- as

held in Falcon Tyres case

For not complying with

Insider Trading Regulations, Market watch dog, SEBI imposed a penalty of Rs. 1

crore on Falcon Tyres and four senior officials.

SEBI imposed falcon Tyres

and Mr. Ruia, who was the Chairman and Promoter Director of the firm and on the

firm’s Executive Director Sunil Bhansali, Non-Executive Director S Ravi and

Company Secretary-cum-Compliance Officer M C Bhansali.

These senior officials, who were holding these

positions during the investigation period, were required to frame a clear code of conduct under

PIT Regulations to prevent Insider Trading and misuse of the price sensitive

information.

However, SEBI found that Falcon Tyres has been

continuing with an ambiguous code since 2008, which undermined this very spirit

that the model code intended to serve. In fact, Sebi said that code of conduct

approved by the Board of Falcon Tyres in December, 2008 “left ample scope for misuse of

price sensitive information”, was detrimental to the interest of the

shareholders of the company and general public and “ambiguous.”

After finding that the five entities had violated PIT (Prohibition of Insider

Trading) Regulations SEBI has imposed a fine totalling Rs 1 crore on

them.

Earlier in 2014, SEBI had imposed the penalty of

Rs. 1 crore on these five entities. Following SEBI’s order, they approached

SAT, which last year set aside the market regulator’s 2014 ruling and ordered a

fresh probe.

Courtesy: Money Control.com

No comments:

Post a Comment