Whether Insolvency and Bankruptcy Code, 2016 (Code) supersedes

any State Law ?

Held yes by Mumbai NCLT in ICICI Bank Ltd vs. Innoventive

Industries Ltd.

ICICI bank has

advanced term loan, working capital facilities and external commercial borrowing

(ECB) to Innoventive Industries Ltd to the tune of Rs1, 019,177,034 as on 30th

November, 2016. As there was a failure to repay the loan by the

Innoventive industries , ICICI bank has initiated an insolvency proceeding

under the Insolvency and Bankruptcy Code, 2016 for the realisation of

money advanced to Innoventive and requested for an order of Moratorium.

What

is Moratorium Order?

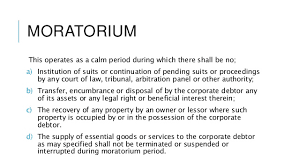

One of the most significant features of

the Code is the grant of moratorium during which creditor action will be

stayed. This is not automatic and has to be granted by the Adjudicating

Authority at the time of admission of the corporate insolvency application. Moratorium

shall continue till completion of corporate insolvency resolution process.

The Adjudicating Authority (NCLT) shall declare

moratorium for prohibiting the following:

- · Transferring, encumbering, alienating or disposing debtor’s assets;

- · Any action to enforce or deal with security interest created by the debtor in respect of its property including under SARFAESI Act, 2002;

- · The recovery by an owner or lessor of any property in the possession of the debtor.

·

Relief

under the Maharashtra Relief Undertaking (Special Provisions) Act, 1958

Innoventive Industries argued that as

they fell under the Maharashtra Relief Undertaking (Special Provisions) Act,

1958, they are entitled for a relief from any pending proceedings before

any court, tribunal, and authorities.

Innoventive Industries

argued that the Maharashtra Relief Undertaking (Special Provisions) Act is

armoured with non-obstante clause in section 4 with the overriding effect.

NCLT Mumbai bench viewed that since IBC 2016 (Code)

has come into existence subsequent to Maharashtra Relief Undertaking (Special

Provisions) Act, 1958, the non–obstante clause of the Code in section 238

thereof would prevail upon any other law for the time being in force, and

it could not be said that the notification given under the Maharashtra Act

would become a block to issue a direction under section 7.

Furthermore, the goal

and aim under the Maharashtra Act is to avert unemployment, and an order under

section 7 of IBC code would not result in any obstacle to their employment

until the next 180 days even if the Innoventive Industries goes into

liquidation.

NCLT viewed that the

liability of the Innoventive Industries has been dealt with by the Maharashtra

Relief Undertaking (Special Provisions) Act (MRU) and also by IBC but with diverse

objectives , as the chief aim of MRU is

to safeguard the interest of the employees whereas under IBC , it is to

safeguard the interest of the creditors who have supplied fuel to the company

to make it run.

Decision

NCLT Mumbai bench

observed that as the petition filed by the financial creditor is being

complete, the same is accepted declaring moratorium with necessary directions.

Nice compilation in lucid manner. Expecting more such pages

ReplyDelete