Important Amendments and Developments under Companies Act 2013

SEBI’s Latest

Notification about dissemination

of Financial Results by Listed Companies

On May 9, 2018, SEBI issued a

Notification and amended of the SEBI LODR Regulation, 2015 in respect of

financial results of listed companies. The following amendment will take place w.e.f. April 1, 2019

(a) Listed entity shall also

submit quarterly/year-to-date consolidated financial results,

OFFERING FOLLOWING SERVICES AS

PRACTICING COMPANY

SECRETARY

For details , Please click the following link:

(b) Listed entity shall also

submit the audited or limited review financial results in respect of the last

quarter along-with the results for the entire financial year, with a note

stating that the figures of last quarter are the balancing figures between

audited figures in respect of the full financial year and the published

year-to-date figures up to the third quarter of the current financial year,

(c) Listed entity shall also submit as part of

its standalone and consolidated financial results for the half year, by way of

a note, statement of cash flows for the half-year,

(d) Listed entity shall ensure that, for the

purposes of quarterly consolidated financial results, at least 80% of each of

the consolidated revenue, assets and profits, respectively, shall have been

subject to audit or in case of unaudited results, subjected to limited review.

(e) Listed entity shall disclose,

in the results for the last quarter in the financial year, by way of a note,

the aggregate effect of material adjustments made in the results of that

quarter which pertain to earlier periods;

(f) Statutory auditor of a listed entity shall undertake a

limited review of audit of all the entities/ companies whose accounts are to be

consolidated with listed entity as per AS 21.

Filing of

e-Form CRL-1 if your company is

more than 2 layers of Subsidiaries.

As ROC has started issue 'Show Cause Notice" in respect

of non-filing of e-form CRL -1 disclosure in respect of more than 2 layer of

subsidiary.

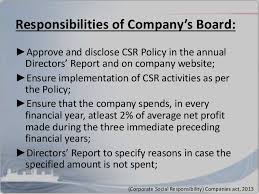

Disclosure of

CSR Spending in Director’s

Report

As ROC has started issue 'Show Cause

Notice" in respect of failure to provide information in the directors

report as regards to CSR spending.

It is advised that company has

to mention in the directors report “ the reasons for not spending the CSR

amount in case if they don’t spend CSR amount during the current year . This

will save the company from receiving show cause notice from Registrar of

Companies.

The following may be the reasons

that may be stated in the Director’s Report for not spending CSR amount.

Liquidity crunch

1. Liquidity crunch--Company is required to spend on

modernization of the existing machinery and borrowed amount is not sufficient

to meet up the requirement for the fund and hence CSR has not been

made. The shortfall will be recouped in the next year.

Not able to

find out suitable CSR activity

2. Time to ascertain proper CSR activities was

very short and hence the Company could not spend required amount

on CSR. The shortfall will be made good in the next

year.

Fire or

Natural Calamity

3. Fire or natural calamity that took place in the factory

and hence, liquidity crunch.

4. Company Incurred loss in any financial year immediately preceding

three financial years.

Carry forwarding

Unspent CSR Amount

It is not clarified by the MCA whether unspent CSR amount

can be carried forward and spent in the succeeding year or not.

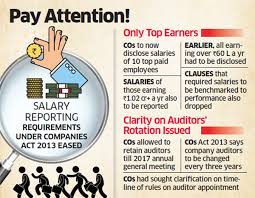

Disclosure

about Employee’s Remuneration

· Names

of top 10 employees in terms of remuneration drawn; and

• Name of every

employee who was in receipt of remuneration not less than Rs. 1.02 Crore per annum

or if employed for a part of financial year with a remuneration not less than

Rs. 8.50 Lakhs p.m.

• Name of every employee who was in receipt of remuneration

in excess of MD/WTD/Manager and holds shares along with his dependents, not

less than 2% of the equity shares of the Company.

This is being perused by many top IT companies who have their major chunk of employees working in abroad.

No Need to Attach the Abstract of MGT-7 in

the

Directors Report

With Companies amendment act 2017, section 92 being

notified, there is no necessity to attach the abstract of annual return with Directors

report. However , if your company has website , you have to upload the annual

return there and you have

to give the link of the Annual Return in the Directors Report.

The Amendment says only for those companies which do have

websites . If the company do not have any website , no need to comply the above

provision.

Further , the details

about the indebtness is also now omitted.

Many thanks for your voluntary service. keep it up.

ReplyDeleteP S NAGASUBRAMANIAM

COMPANY SECRETARY

Nice to see the useful info. Great service to needy!

ReplyDeleteSo luck to come across your excellent blog. Your blog brings me a great deal of fun.. Good luck with the site.

ReplyDeletenocov

Great post full of useful tips! My site is fairly new and I am also having a hard time getting my readers to leave comments. Analytics shows they are coming to the site but I have a feeling “nobody wants to be first”.

ReplyDeleteofficial source