In this column , I will discuss important company law case laws and intricacies surrounding the interpretation of Indian Company Law.

Sunday, September 30, 2018

Saturday, September 29, 2018

COMPLIANCES CALENDER FOR LISTED COMPANIES FOR THE MONTH OF OCTOBER 2018 under SEBI Listing Regulations 2015 (LODR)

COMPLIANCES CALENDER FOR

LISTED COMPANIES FOR THE MONTH OF OCTOBER 2018 under SEBI Listing

Regulations 2015 (LODR)

To BSE or Stock Exchange registered with by Listed Entitly

S.No

|

Nature of Compliances

|

Details of Compliances

|

Deadline

|

1

|

Compliance Certificate under Clause 7(3)

|

The listed entity shall

submit a compliance certificate to the exchange, duly signed by both that is

by the compliance officer of the listed entity and the authorized

representative of the share transfer agent, wherever applicable, within one

month of end of each half of the financial year, certifying maintaining

physical & electronic transfer facility either in house or RTA as

applicable.

|

30th

October 2018

|

2

|

Statement of Investors Complaints under

Clause 13 (3)

|

The listed entity shall file

with the recognised stock exchange(s) on a quarterly basis, within twenty one

days from the end of each quarter, a statement giving the number of investor

complaints pending at the beginning of the quarter, those received during the

quarter, disposed of during the quarter and those remaining unresolved at the

end of the quarter.

|

20th October 2018

|

Corporate Governance under

Clause 27(2)

|

The listed entity shall submit a quarterly

compliance report on corporate governance within fifteen days from close of

the quarter.

Further it may be noted that it shall not apply, in respect

of –

(a)

the

listed entity having paid

up equity share capital not exceeding rupees ten crore and net worth not

exceeding rupees twenty five crore, as on the last day of the previous

financial year:

Provided that where the provisions of the regulations specified

in this regulation becomes applicable to a listed entity at a later date,

such listed entity shall comply with the requirements those regulations

within six months from the date on which the provisions became applicable to

the listed entity.

(b) the listed entity

which has listed its specified securities on the SME Exchange.

|

15th

October 2018

|

|

Shareholding Patterns under Regulation 31

|

1) The listed entity shall submit to the

stock exchange(s) a statement showing holding of securities and shareholding

pattern separately for each class of securities, in the format specified by

the Board from time to time within the following timelines -

·

one day prior to listing of its securities

on the stock exchange(s);

·

on a quarterly basis, within twenty one days

from the end of each quarter;

·

within ten days of any capital restructuring

of the listed entity resulting in a

change exceeding two per cent of the total paid-up share capital: Provided that in case of listed entities which have listed their specified securities on SME Exchange, the above statements shall be submitted on a half yearly basis within twenty one days from the end of each half year. |

20th October

|

|

Regulation 33 - Financial Results.

|

The listed entity shall submit quarterly and

year-to-date standalone financial results to the stock exchange within

forty-five days of end of each quarter, (other than last quarter ) along with

Limited Review Report or Audit Report as applicable.

|

14 November 2018

|

|

Reconciliation of Share capital under Clause 55A

|

Listed entities are required

to submit Reconciliation of Share Capital Audit Report on a quarterly basis

to the stock exchanges audited by a qualified chartered accountant or a

practicing company secretary for the purpose of reconciliation of share capital

held in depositories and in physical form with the issued / listed capital.

The Reconciliation of Share Capital Audit Report is required to be submitted

to the stock Exchange within 30 days from the end of the Quarter under

regulation 55A of the SEBI (Depositories and Participants) Regulations, 1996.

|

30th

October 2018

|

|

Certificate from Practicing Company

Secretary under Clause 40(9)

|

The listed entity shall

ensure that the share transfer agent and/or the in-house share transfer

facility, as the case may be, produces a certificate from a practicing

company secretary within one month of the end of each half of the financial

year, certifying that all certificates have been issued within thirty days of

the date of lodgment for transfer, sub-division, consolidation, renewal,

exchange or endorsement of calls/allotment monies.

|

30th October 2018

|

|

Corporate Governance under

Clause 27(2)

|

The listed entity shall

submit a quarterly compliance report on corporate governance within fifteen

days from close of the quarter. Further it may be noted that it shall not

apply, in respect of - (a) the listed entity having paid up equity share

capital not exceeding rupees ten crore and net worth not exceeding rupees

twenty five crore, as on the last day of the previous financial year:

Provided that where the provisions of the regulations specified in this

regulation becomes applicable to a listed entity at a later date, such listed

entity shall comply with the requirements those regulations within six months

from the date on which the provisions became applicable to the listed entity.

(b) the listed entity which has listed its specified securities on the SME

Exchange.

|

15th

October 2018

|

|

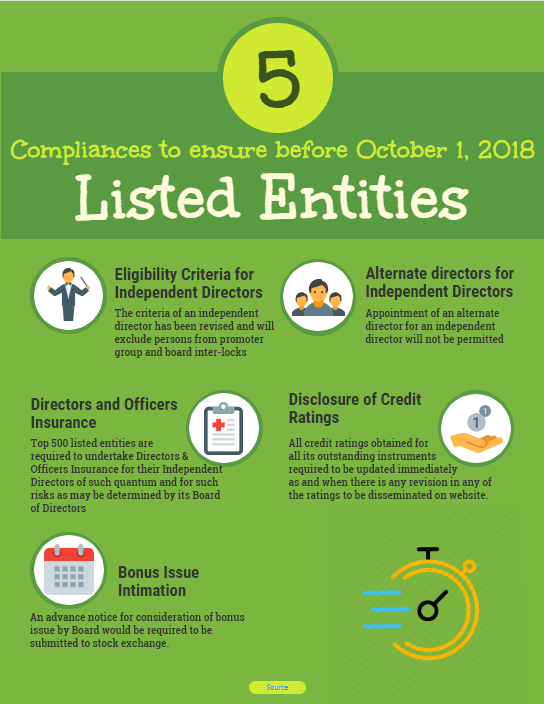

Independent Director (ID) Eligibility -Reg.

16(1)(b) & 25

|

ØSpecifically

exclude persons who constitute the “Promoter Group” of listed entity

Exclude‘Board inter-locks’

i.e. non-ID of another Company on the Board of which any non-ID of listed

entity is an ID

Appointment of Alternate Director for an ID

is not permitted

Directors & Officers liability

insuranceID for Top 500as on 31-Mar-18

|

1st

October 2018

|

|

Disclose credit ratings for all listed entity’s outstanding

instruments & immediately update any revision in such ratings

|

1st

October 2018

|

||

Bonus

Issue : Reg. 29-submit advance notice for consideration of Bonus issue by the

Board to the Stock Exchanges

|

1st

October 2018

|

OTHER COMPLIANCES UNDER

COMPANIES ACT , INCOME-TAX ETC

S.No

|

Name

of Compliance

|

Deadline

|

1

|

GSTR-1

|

11th

October 2018

|

2

|

ADT-1

(Appointment of Statutory Auditor) if applicable

|

14th

October 2018 ( 15 days from the date of AGM)

|

3

|

TCS

Return

|

15th

October 2018

|

4

|

Tax

Audit and ITR

|

15th

October 2018

|

5

|

GSTR

4 Composition

|

18th

October 2018

|

6

|

GSTR

3B

|

20th

October 2018

|

7

|

AOC

-4 (ROC)

|

29th

October 2018 ( or within 30 days from AGM date)

|

8

|

GSTR

1 (Rs < 1.5 Crores)

|

31st

October 2018

|

9

|

TDS

Return

|

31st

October 2018

|

AFFORDABLE

FILING FEES FOR YOUR COMPANY NEEDS

FORM

DIR -3 KYC ( Filling , certifying and

filing)

|

Rs

750/= per form

|

Avoidf

Penalty of Rs 5000 before October

5,2018

|

FORM

AOC -4 – Filling Data , certifying and uploading the form

|

Rs

6000/= per form

|

Avoid penalty of Rs 100/= per day after 30 days

of AGM

|

FORM

MGT-7 Form Filling , certifying and uploading

|

Rs

6000/= per form

Rs

15000/= per form with MGT-8 Certification

|

Avoid penalty of Rs 100/= per day after 60 days

of AGM

|

FORM

XBRL – FORM Filling , certifying and Uploading

|

Rs

10000/= per form

|

Avoid penalty of Rs 100/= per day after 30 days

of AGM

|

CONTACT = R V Seckar PCS

9848915177 , 7804719295

rvsekar2007@gmail.com

Wednesday, September 26, 2018

WILL MCA EXEMPT NIDHI COMPANIES FROM COMPULSORY DEMATERIALISATION ?

WILL MCA EXEMPT NIDHI COMPANIES FROM COMPULSORY DEMATERIALISATION ?

WHAT IS A NIDHI OR MUTUAL

BENEFIT COMPANY? HOW TO REGISTER A

NIDHI COMPANY?

As per section 406 of the Companies Act, 2013, “Nidhi” means a

company which has been incorporated as a Nidhi with the object of cultivating

the habit of thrift and savings amongst its members, receiving deposits from,

and lending to, its members only, for their mutual benefit, and which complies

with such rules as are prescribed by the Central Government for regulation of

such class of companies.

Nidhi” is a Hindi word, which means finance or fund. Nidhi means

a company which has been incorporated with the object of developing the habit

of thrift and reserve funds amongst its members and also receiving deposits and

lending to its members only for their mutual benefit.

Nidhi Company is one of the category of Non Banking Financial

Company (NBFC) which does not require any Reserve Bank of India (RBI) license.

Nidhi Company works through its members. It can accept deposits and lends loans

to its members only.

NO LICENSE FROM RBI IS

REQUIRED TO INCORPORATE A NIDHI COMPANY

Nidhi Company is one of the category of Non Banking Financial

Company (NBFC) which does not require any Reserve Bank of India (RBI) license.

Nidhi Company works through its members. It can accept deposits and lends loans

to its members only.

NIDHI COMPANY IS A KIND OF

NBFC

The alternatives of Nidhi (like Non Banking Financial Companies

(NBFC’s) will need a capital of at least two crores) are very costly. Through,

very business friendly, Nidhi is yet to be common between the business

communities.

FUNDAMENTALS OF A NIDHI

COMPANY

1. Nidhi Company is

also called a Mutual Benefit company. It promotes the art of saving and

utilization of funds within its member community.

2. Anybody can register a

Nidhi Company; there is no background check, nor there did any prescribe

qualification for its owners.

3. Nidhi Company cannot deal

with anybody other than its members. You will have to understand the process of

making a making in a Nidhi.

4. The minimum capital

requirement for Nidhi Company is five lacs (Rs 5 lacs) with at least seven members needed

to incorporate a company.

CONDITIONS THAT ARE TO BE

SATISFIED DURING INCORPORATION

·

Minimum

paid capital should be Rs.5,00,000.

·

No

preference shares can be issued.

CONDITIONS AFTER

INCORPORATION

Every company should ensure the

following within 1 year.

·

Minimum

members must not be less than 200.

·

Minimum

net owned fund should be at least Rs.10,00,000.

·

The

ratio between net owned funds and deposits must not be more than 1:20.

·

No

body corporate or trust must be admitted to it as its member.

·

A

minor should be a part of it.

DIRECTORS

·

The

minimum number of directors should be 3.

·

The

director should be the member of the company.

·

The

director should be appointed for a minimum of 10 years.

FORMALITIES FOR REGISTRATION

OF A NIDHI COMPANY

All the formalities of registration

of a Nidhi company is the same as formalities of a public company.

ADVANTAGES OF NIDHI COMPANY

REGISTRATION

SEPARATE LEGAL ENTITY

A company is a legal

entity and a juristic person established under the Companies Act. Therefore a

company form of organization has wide legal capacity and can own property and

also incur debts. The members (Shareholders/Directors) of a company have no

liability to the creditors of a company for such debts.

2. UNINTERRUPTED

EXISTENCE

A company has

'perpetual succession', that is continued or uninterrupted existence until it

is legally dissolved. A company, being a separate legal person, is unaffected

by the death or other departure of any member but continues to be in existence

irrespective of the changes in membership.

3. BORROWING CAPACITY

A company enjoys better

avenues for borrowing of funds. It can issue debentures, secured as well as

unsecured and can also accept deposits from the public, etc. Even banking and

financial institutions prefer to render large financial assistance to a company

rather than partnership firms or proprietary concerns.

4. EASY TRANSFERABILITY

Shares of a company

limited by shares are transferable by a shareholder to any other person. Filing

and signing a share transfer form and handing over the buyer of the shares

along with share certificate can easily transfer shares.

5. OWNING PROPERTY

A company being a

juristic person, can acquire, own, enjoy and alienate, property in its own

name. No shareholder can make any claim upon the property of the company so

long as the company is a going concern.

6. LIMITED LIABILITY

Limited Liability means

the status of being legally responsible only to a limited amount for debts of a

company. Unlike proprietorships and partnerships, in a limited liability

company the liability of the members in respect of the company's debts is

limited.

7. FUNDING READY

Nidhi Company can

provide investment to smaller classes with less interest.

EXEMPTIONS TO A NIDHI COMPANY

PRIVATE PLACEMENT BY NIDHI

[SECTION 42]:

A Nidhi company is free to make private placement to

any number of persons and it shall not be deemed to be an offer to the public.

[As Section 42(2) and the explanation I thereof is not applicable to Nidhi].

ACCEPTANCE OF SUBSCRIPTION

MONEY BY CASH

Nidhi Company may accept

subscription money in cash as the provisions of sub-section (5) of section 42

is not applicable to Nidhi.

NO RESTRICTION ON PRIVATE

PLACEMENT

Nidhi Company may offer the private placement to any

person without recording their name and there is no need to file

the complete information about such offer with the Registrar because

sub-section (7) of section 42 of CA 2013 shall not apply to Nidhi.

RESTRICTION ON VOTING RIGHTS

No member of a Nidhi Company shall exercise voting rights on

poll in excess of 5% of total voting rights of equity shareholders. Thus,

every member of a Nidhi Company shall have a right to vote on every resolution

placed before the company and his voting right on a poll shall be subject to 5%

of total voting rights of equity shareholders.

HOW DEMATERIALISATION AFFECTS

NIDHI COMPANIES

Now , it is mandatory to public unlisted companies have to

dematerialize their shares. Nidhi Companies will have thousands of shareholders

with 1 shareholding each. It would be really difficult for the Nidhi companies

to dematerialize the shares of its members who holds only one share. MCA should

come forward to exempt the Nidhi

companies from the mandatory dematerialization of shares.

AFFORDABLE

FILING FEES FOR YOUR COMPANY NEEDS

|

FORM

DIR -3 KYC ( Filling , certifying and

filing)

|

Rs

750/= per form

|

Avoidf

Penalty of Rs 5000 before October

5,2018

|

|

FORM

AOC -4 – Filling Data , certifying and uploading the form

|

Rs

6000/= per form

|

Avoid penalty of Rs 100/= per day after 30 days

of AGM

|

|

FORM

MGT-7 Form Filling , certifying and uploading

|

Rs

6000/= per form

Rs

15000/= per form with MGT-8 Certification

|

Avoid penalty of Rs 100/= per day after 60 days

of AGM

|

|

FORM

XBRL – FORM Filling , certifying and Uploading

|

Rs

10000/= per form

|

Avoid penalty of Rs 100/= per day after 30 days

of AGM

|

Subscribe to:

Comments (Atom)